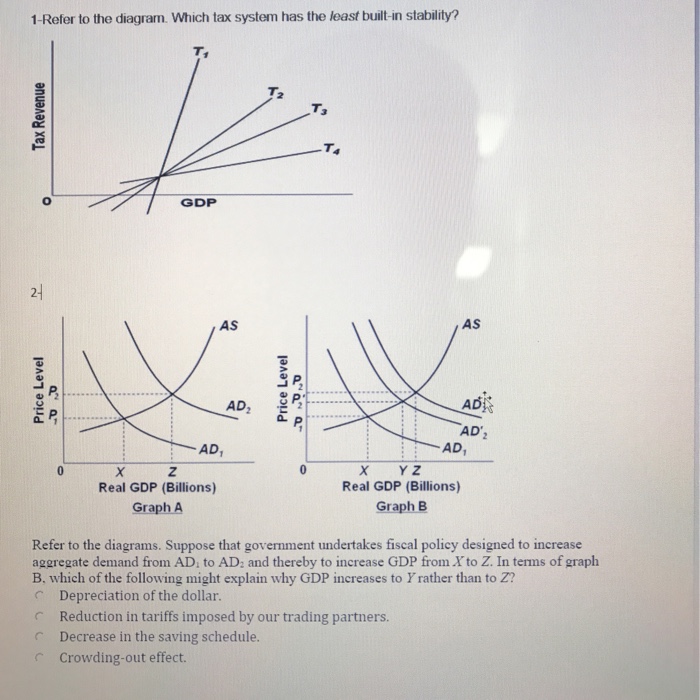

Refer To The Diagram Which Tax System Has The Most Built In Stability

Use the following to answer question 5. C at any level of gdp below 400.

Understanding California S Property Taxes

Understanding California S Property Taxes

If aggregate demand curve ad 1 describes the current situation appropriate fiscal policy would be to.

Refer to the diagram which tax system has the most built in stability. Refer to the above diagram which tax system has the least built in stability a vccs eco 201202 spring 2008. Refer to the above diagram wherein t is tax revenues and g is government expenditures. Refer to the above diagram.

Bthe most appropriate fiscal policy is an increase of government expenditures or a reduction of taxes. The budget will entail a deficit. Refer to the above diagram for a private closed economy.

True false in the aggregate expenditures model presented in the textbook investment is assumed to rise with increases in real gdp and fall with decreases in real gdp. Refer to the above diagram in which qf is the full employment output. 1 refer to the diagram.

Which tax system has the least built in stability. All figures are in billions of dollars. Study 25 quiz5 flashcards from ann s.

Study 25 quiz5 flashcards from ann s. Athe economy is achieving its maximum possible output. The equilibrium level of gdp is.

Refer to the above diagram in which q f is the full employment output. Refer to the diagram where t is tax revenues and g is government expenditures. Suppose that government undertakes fiscal policy designed to increase aggregate demand from ad1 to ad2 and thereby to increase gdp from x to z.

Bchanging the tax system so that the tax line is shifted downward but parallel to its present position. The degree of built in stability in the above economy could be increased by. If the economys present aggregate demand curve is ad2.

Refer to the above diagram wherein t is tax revenues and g is government expenditures. Areducing government purchases so that the purchases line shifts downward but parallel to its present position. Refer to the above diagram.

Refer to the above diagram which tax system has the most built in stability a t from econ 301 at devry university fremont. D only when gdp is stable. Refer to the above diagram.

Which tax system has the least built in stability. Which tax system has the most built in stability. This diagram portrays the notion of.

B at any level of gdp above 400. Which tax system has the most built in. A refer to the diagrams.

All figures are in billions. All figures are in billions. A at all levels of gdp.

Common Claims About Proposition 13

Common Claims About Proposition 13

The Economy Unit 17 The Great Depression Golden Age And Global

The Economy Unit 17 The Great Depression Golden Age And Global

A Global Perspective On Territorial Taxation Tax Foundation

A Global Perspective On Territorial Taxation Tax Foundation

Evaluating Fiscal Policy Boundless Economics

Evaluating Fiscal Policy Boundless Economics

Post World War Ii Economic Expansion Wikipedia

Post World War Ii Economic Expansion Wikipedia

Automatic Stabilization And Discretionary Fiscal Policy In The

Automatic Stabilization And Discretionary Fiscal Policy In The

Solved 1 Refer To The Diagram Which Tax System Has The L

Solved 1 Refer To The Diagram Which Tax System Has The L

How Past Income Tax Rate Cuts On The Wealthy Affected The Economy

How Past Income Tax Rate Cuts On The Wealthy Affected The Economy

Ec1001 Question Sheet 1 Tutorial 1 Week 16

Ec1001 Question Sheet 1 Tutorial 1 Week 16

Types Of Tax Systems Intelligent Economist

Types Of Tax Systems Intelligent Economist

The Economy Unit 17 The Great Depression Golden Age And Global

The Economy Unit 17 The Great Depression Golden Age And Global

Uk Balance Of Payments Economics Help

Uk Balance Of Payments Economics Help

Understanding California S Property Taxes

Understanding California S Property Taxes

0 Response to "Refer To The Diagram Which Tax System Has The Most Built In Stability"

Post a Comment